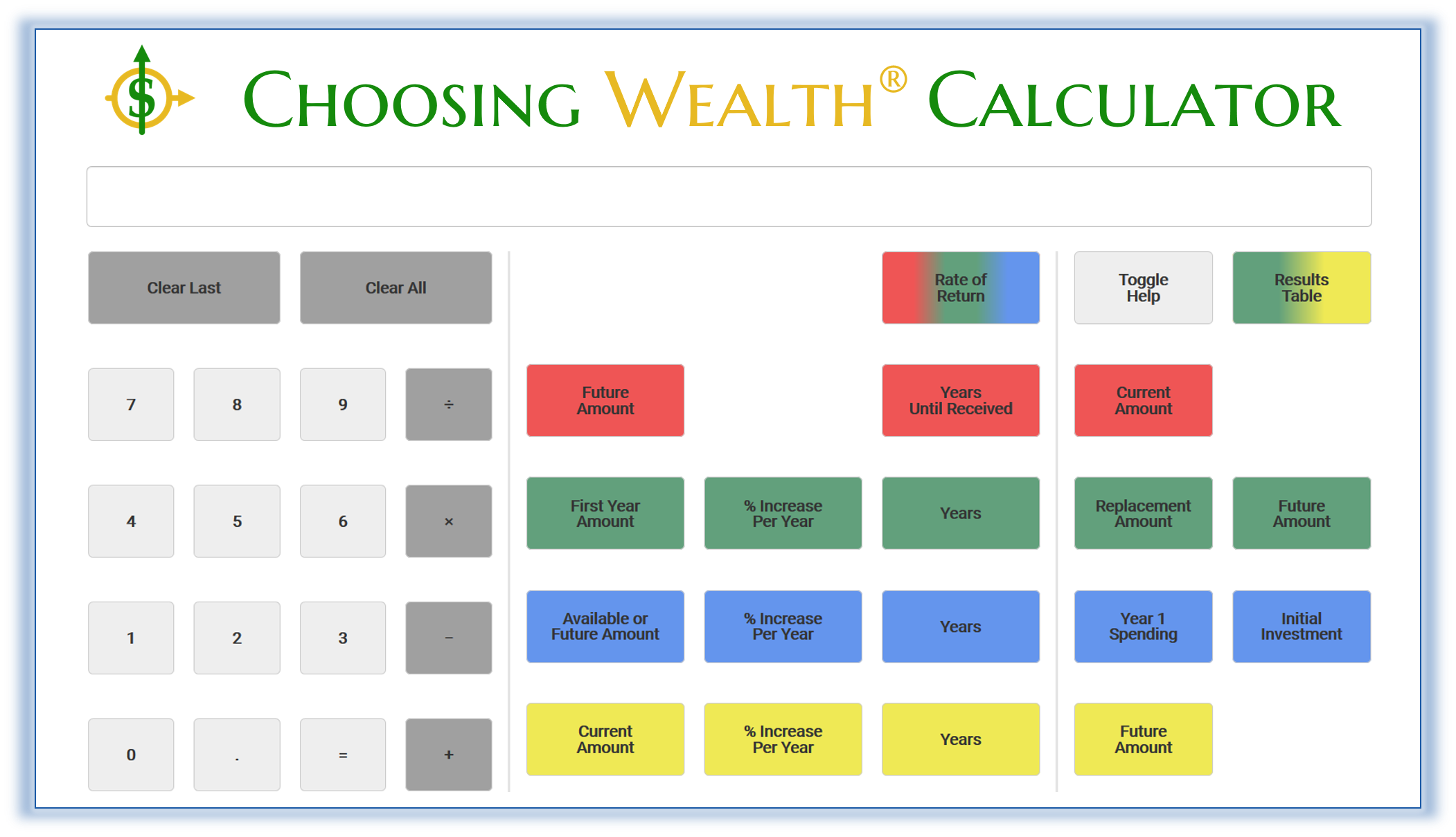

Choosing Wealth® Calculator at-a-glance

Before purchasing any of our products contact your employer, school, financial adviser, benefits provider, nonprofit or worship center to see if you are eligible for a discount. We may be in a benefits or membership package they provide, or part of the products and services they offer.

If they are not enrolled in our Alliance Partner program they can click here for our Join page or call us at 321.252.8628 or email mission@choosingwealth.com.

Subscriptions Include

Choosing wealth is as easy as 1-2-3. Subscribe. Learn. Do. Every subscription to the Choosing Wealth® Calculator includes full access to our education hub, the Wealth Literacy Institute. There you can learn more about how to make wealthy choices in everyday financial scenarios with the Choosing Wealth® Calculator, plus wealth literacy concepts to help you do things that create a lifestyle where your money outlives you℠.

Simple to Use

Easy to do! Enter your values then select color-coded variable and calculation keys. For convenience and accuracy, the Choosing Wealth® Calculator displays the values you enter and calculation results below the keys. You can print results tables for Green and Yellow calculations, and toggle help on and off, too.

Unlimited Scenarios for Targeted Results

You are in control of the values you use and the assumptions you make. For example, how much you start with or rate of return or inflation. Use the Choosing Wealth® Calculator to run comparisons that guide you to the wealthiest choice.

Safe and Secure

ChoosingWealth.com is a secure site and your entries and results are never captured or stored by our company or our platform.

User Guide and How to Videos

Need some help getting started? View the Quick Start Guide here! A few introductory tutorials are here.