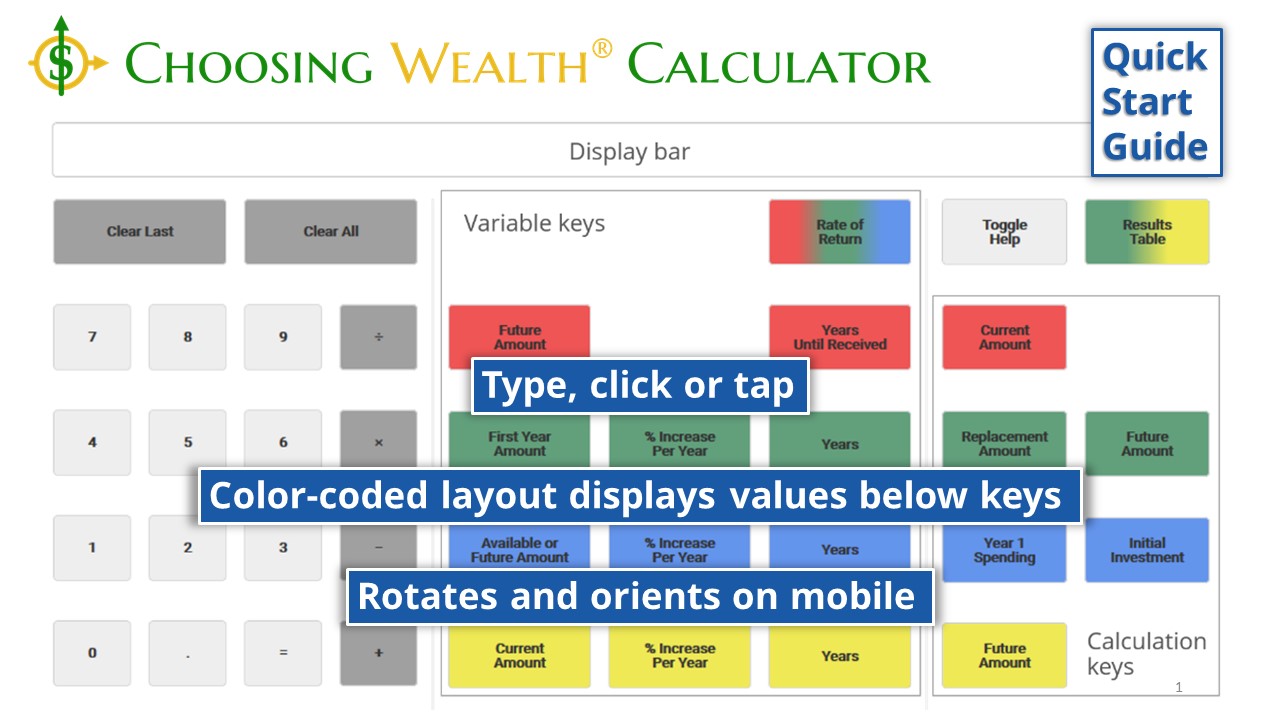

Choosing Wealth® Calculator Quick Start Guide

NOTE:

- The examples below are only a few of the normal life situations the Choosing Wealth® Calculator can help with.

- Login at Wealth Literacy Institute for an expanding library of calculations for other normal life situations.

Simple to Use | Easy to Do - Use your own assumptions and values. Unlimited calculations. Targeted answers.

Choosing Wealth® Calculator Quick Start Guide | Page 1

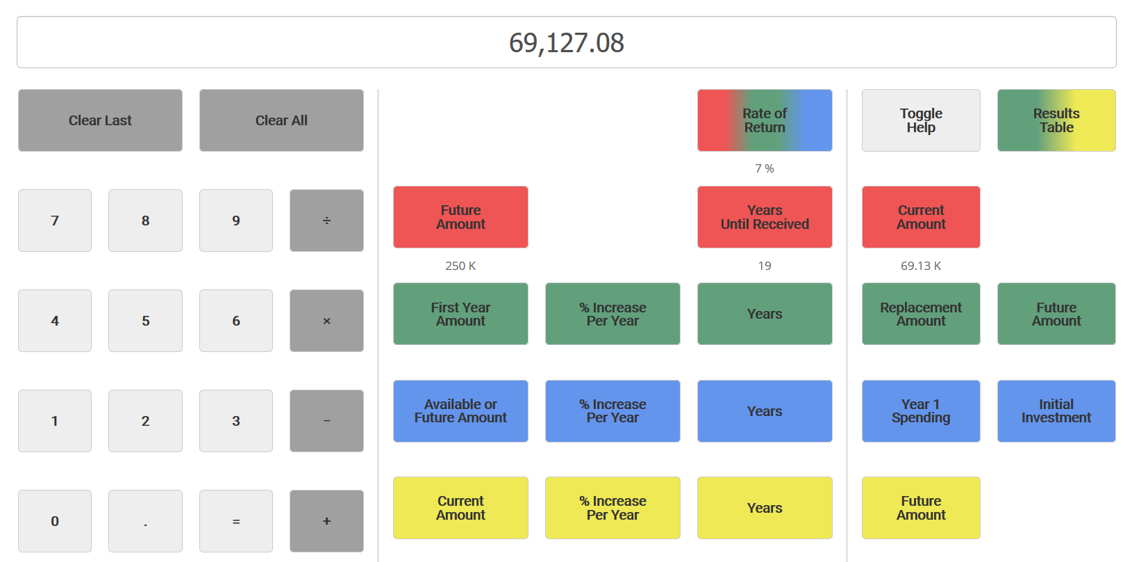

Red Keys - How much do I need to invest today to have $250,000 in 20 years? What's the calculation?

CALCULATE THE PRESENT VALUE/COST OF A FUTURE INVESTMENT, BENEFIT OR EXPENSE

You know a future value and want to know what it would be worth at some number of years before you will receive it.

The value displayed, $69,127.08, is what you would need to invest now to be worth $250,000, using the assumptions below – a 7% rate of return over a 19 year span.

Choosing Wealth® Calculator Quick Start Guide | Red Keys | Page 2

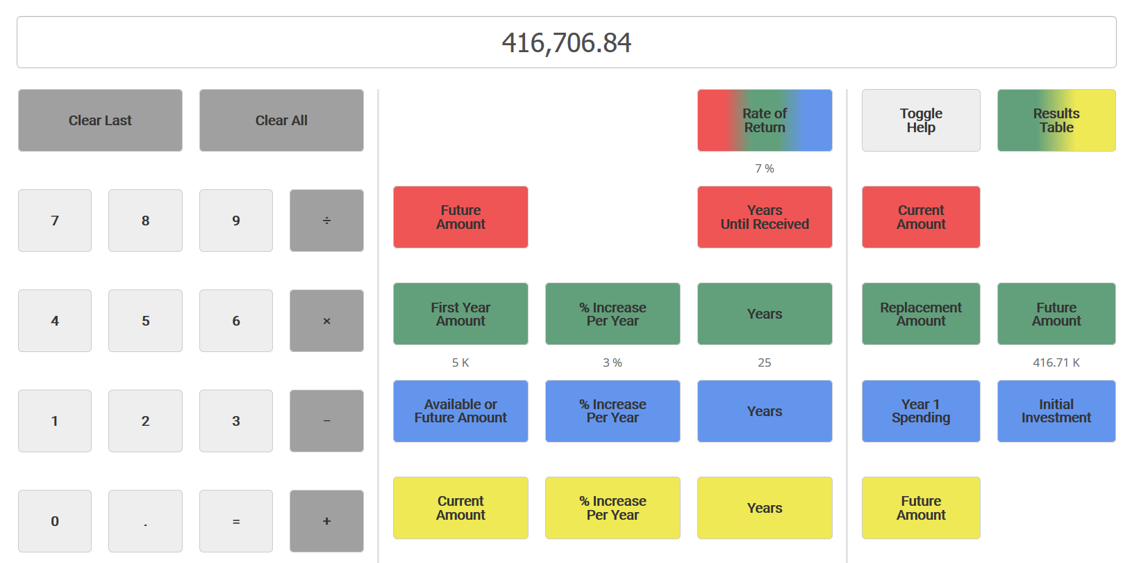

Green Keys | Future Amount - I have $5,000 to invest per year, can it grow to $400,000 in 25 years? What's the calculation?

CALCULATE THE FUTURE VALUE OF TWO OR MORE ANNUAL INVESTMENTS

The annual investment can remain fixed each year or increase by a fixed percentage. The value displayed $416,706.84, is what your investments would be worth, using the assumptions below – begin with $5,000 then increase 3% annually, a 7% rate of return, and 25 years.

Choosing Wealth® Calculator Quick Start Guide | Green Keys | Page 3

Green Keys | Replacement Amount - How much funds an $80,000/year retirement lifestyle for 20 years? What's the calculation?

CALCULATE THE INVESTMENT NEEDED TO GENERATE/PAY FOR TWO OR MORE YEARS OF FUTURE ANNUAL BENEFITS/EXPENSES

You want to know how much money invested each year for two or more years would be worth in the future. The annual investment can remain fixed each year or increase by a fixed percentage.

The value displayed, $1,343,221.17, is what you would need so you could withdraw $80,000 the first year, using the assumptions below – a 6% rate of return and 4% annual withdrawal increase.

Choosing Wealth® Calculator Quick Start Guide | Green Keys | Page 4

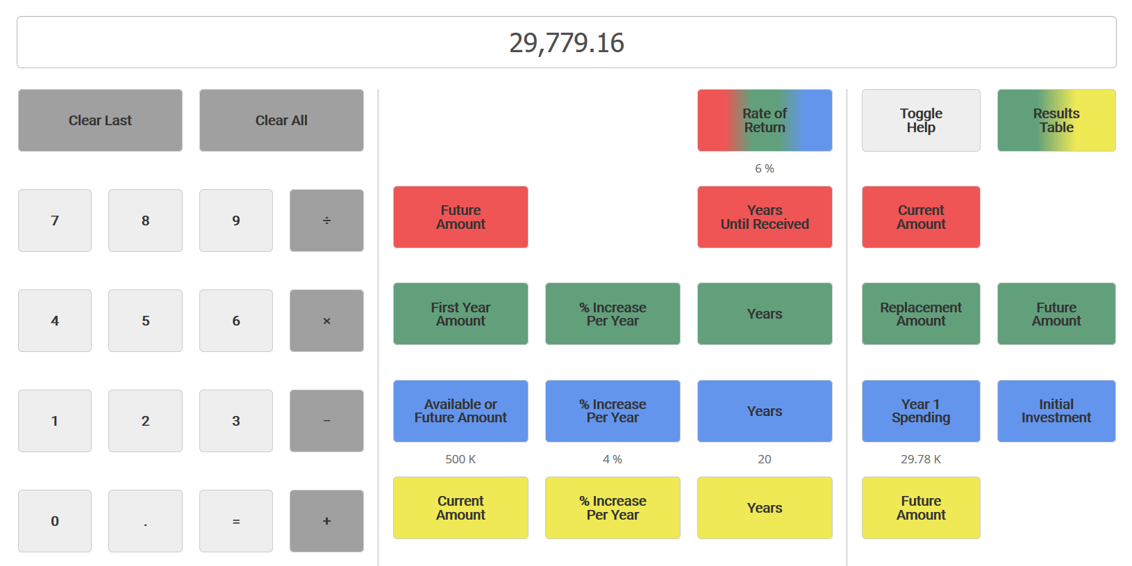

Blue Keys | Year 1 Spending - How much can I take out each year if I have $500,000 to last for 20 years? What's the calculation?

CALCULATE THE INITIAL ANNUAL SPENDING ALLOWED FROM A SPECIFIED INVESTMENT AMOUNT FOR A SPECIFIED NUMBER OF YEARS

You know how much money you have available to generate income with and want to know how much you can withdraw in year 1. This assumes the investment amount is fully depleted in the years specified.

The value displayed, $29,779.16, is how much you could withdraw your first year, using the assumptions below – a 6% rate of return and a 4% annual withdrawal increase.

Choosing Wealth® Calculator Quick Start Guide | Blue Keys | Page 5

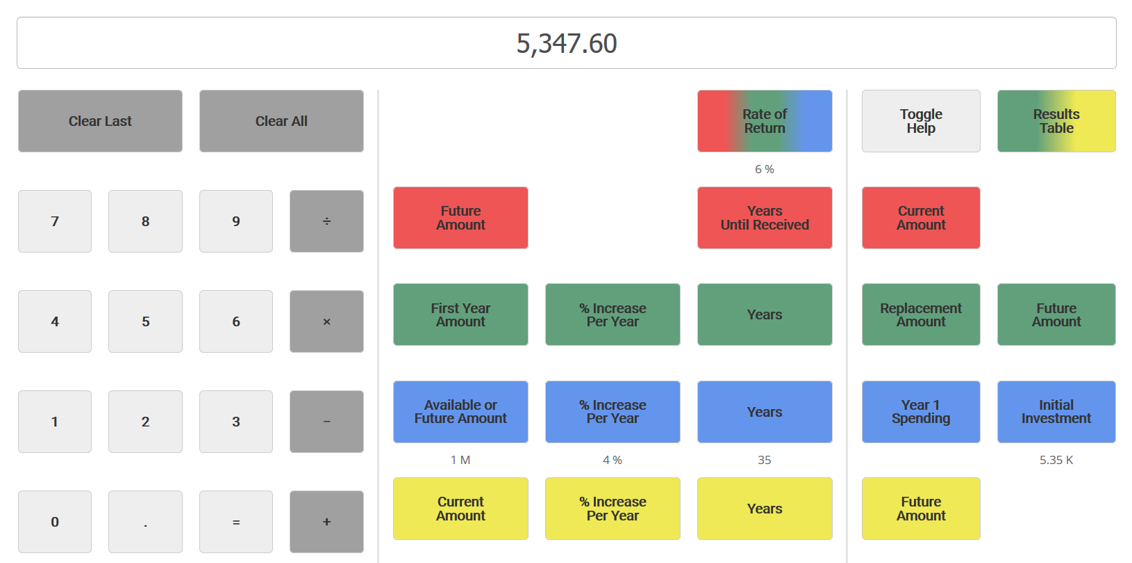

Blue Keys | Initial Investment - How much do I need to start with if I want $1M in 35 years? What's the calculation?

CALCULATE THE INITIAL ANNUAL INVESTMENT NEEDED TO ACCUMULATE A SPECIFIED FUTURE AMOUNT

You know how much money you want to accumulate in a time period and want to know what the initial investment would be.

The value displayed. $5,347.60, is how much you would need to invest your first year for a future $1 million, using the assumptions below – a 6% rate of return and a 4% annual investment increase.

Choosing Wealth® Calculator Quick Start Guide | Blue Keys | Page 6

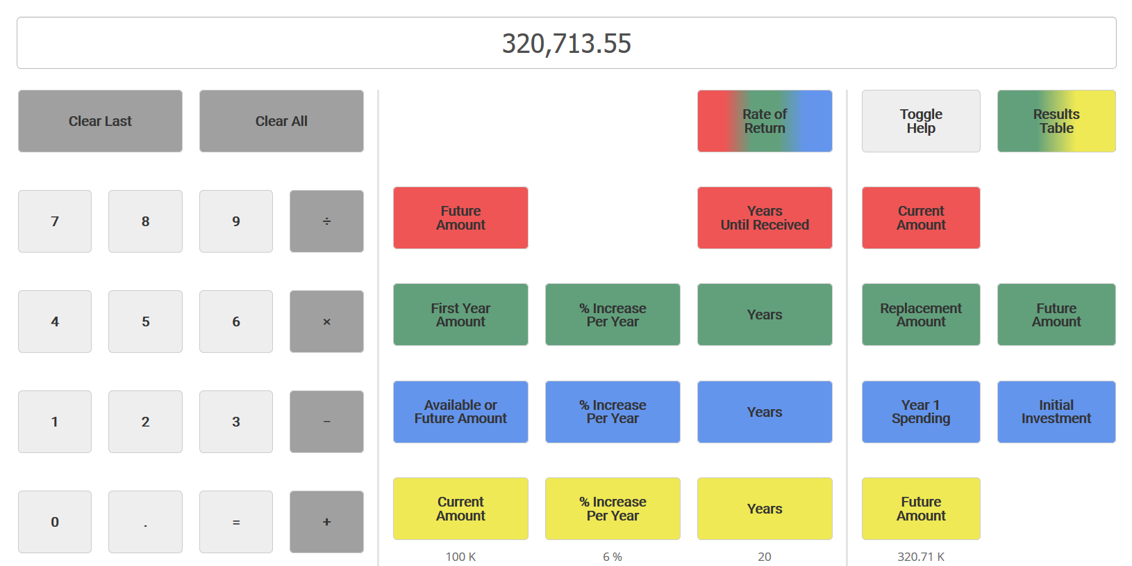

Yellow Keys - How much will my $100,000 401(k) rollover be worth in 20 years? What's the calculation?

CALCULATE THE FUTURE VALUE/COST OF A CURRENT INVESTMENT/EXPENSE

The value displayed, $320,713.55, is what your $100,000 would be worth, using the assumptions below – a 6% annual appreciation for 20 years.

Choosing Wealth® Calculator Quick Start Guide | Yellow Keys | Page 7